Avoidable Fixed Costs Quizlet . in a sell or process further decision, consider the following costs: some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. one approach is to compare contribution margins and fixed costs. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. Avoidable costs refer primarily to variable costs that can be. It can be removed, ceasing to conduct the specified commercial. In this method, the contribution margins with and without the. an avoidable cost is an expense that will not be incurred if a particular activity is not performed. avoidable cost is a business cost incurred by a firm that does not serve a purpose. We will cover the avoidable. this blog will delve into avoidable costs and discuss how companies can identify and reduce them to improve their bottom line.

from www.chegg.com

We will cover the avoidable. in a sell or process further decision, consider the following costs: an avoidable cost is an expense that will not be incurred if a particular activity is not performed. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. this blog will delve into avoidable costs and discuss how companies can identify and reduce them to improve their bottom line. In this method, the contribution margins with and without the. Avoidable costs refer primarily to variable costs that can be. one approach is to compare contribution margins and fixed costs. It can be removed, ceasing to conduct the specified commercial. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant.

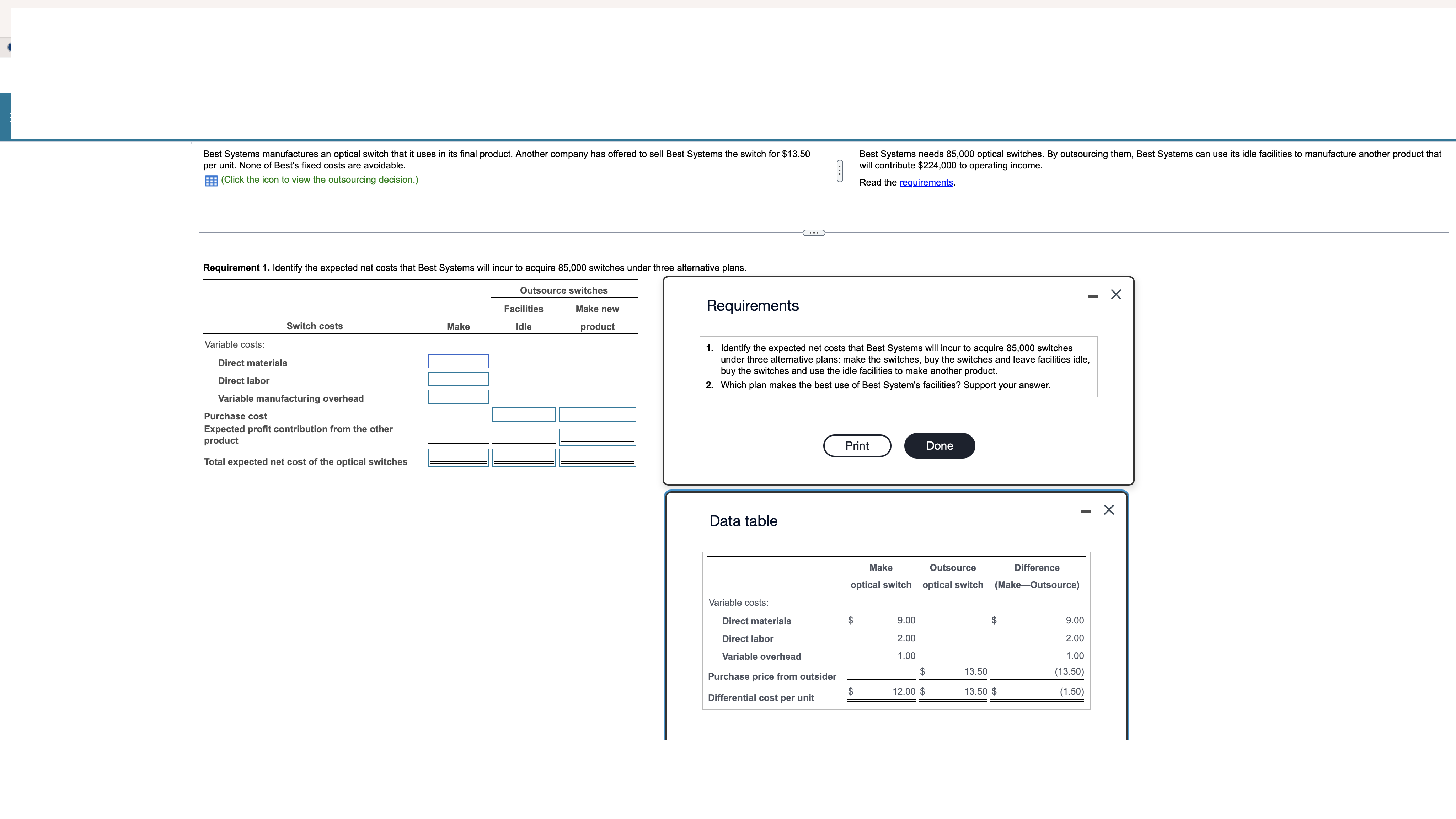

Solved per unit. None of Best's fixed costs are avoidable. 用

Avoidable Fixed Costs Quizlet Avoidable costs refer primarily to variable costs that can be. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. one approach is to compare contribution margins and fixed costs. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. We will cover the avoidable. Avoidable costs refer primarily to variable costs that can be. avoidable cost is a business cost incurred by a firm that does not serve a purpose. an avoidable cost is an expense that will not be incurred if a particular activity is not performed. this blog will delve into avoidable costs and discuss how companies can identify and reduce them to improve their bottom line. in a sell or process further decision, consider the following costs: It can be removed, ceasing to conduct the specified commercial. In this method, the contribution margins with and without the.

From quizlet.com

For the coming year, Loudermilk Inc. anticipates fixed costs Quizlet Avoidable Fixed Costs Quizlet Avoidable costs refer primarily to variable costs that can be. We will cover the avoidable. In this method, the contribution margins with and without the. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant.. Avoidable Fixed Costs Quizlet.

From ceuhhcid.blob.core.windows.net

Fixed Cost Vs Variable Cost Quizlet at Fannie Thomas blog Avoidable Fixed Costs Quizlet It can be removed, ceasing to conduct the specified commercial. avoidable cost is a business cost incurred by a firm that does not serve a purpose. We will cover the avoidable. one approach is to compare contribution margins and fixed costs. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. . Avoidable Fixed Costs Quizlet.

From quizlet.com

A worker costs 100 a day, and the firm has fixed costs of2 Quizlet Avoidable Fixed Costs Quizlet Avoidable costs refer primarily to variable costs that can be. It can be removed, ceasing to conduct the specified commercial. in a sell or process further decision, consider the following costs: some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. avoidable cost is a business cost incurred by a firm that. Avoidable Fixed Costs Quizlet.

From quizlet.com

A firm's fixed costs are 14 and the variable costs are 2 per Quizlet Avoidable Fixed Costs Quizlet Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. We will cover the avoidable. in a sell or process further decision, consider the following costs: one approach is to compare contribution margins and fixed costs. some typical classes of avoidable costs include direct materials, direct labor, variable. Avoidable Fixed Costs Quizlet.

From www.numerade.com

SOLVED A division of a large company reports the information shown below for a recent year Avoidable Fixed Costs Quizlet one approach is to compare contribution margins and fixed costs. We will cover the avoidable. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. In this method, the contribution margins with and without. Avoidable Fixed Costs Quizlet.

From www.slideserve.com

PPT Chapter 9 PowerPoint Presentation, free download ID6468774 Avoidable Fixed Costs Quizlet In this method, the contribution margins with and without the. an avoidable cost is an expense that will not be incurred if a particular activity is not performed. Avoidable costs refer primarily to variable costs that can be. avoidable cost is a business cost incurred by a firm that does not serve a purpose. one approach is. Avoidable Fixed Costs Quizlet.

From www.chegg.com

Solved Exercise 63A (Algo) Distinction between avoidable Avoidable Fixed Costs Quizlet avoidable cost is a business cost incurred by a firm that does not serve a purpose. We will cover the avoidable. Avoidable costs refer primarily to variable costs that can be. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. In this method, the contribution margins with and without the. It can. Avoidable Fixed Costs Quizlet.

From www.studocu.com

Chapter 8 Tessa Kohr Prof. Bartiromo ACC 222 10/5/ Chapter 8 Vocab Avoidable Fixed Costs Avoidable Fixed Costs Quizlet It can be removed, ceasing to conduct the specified commercial. avoidable cost is a business cost incurred by a firm that does not serve a purpose. one approach is to compare contribution margins and fixed costs. In this method, the contribution margins with and without the. Avoidable costs refer primarily to variable costs that can be. in. Avoidable Fixed Costs Quizlet.

From quizlet.com

In the earlier example, the fixed costs are split 4 million Quizlet Avoidable Fixed Costs Quizlet one approach is to compare contribution margins and fixed costs. avoidable cost is a business cost incurred by a firm that does not serve a purpose. In this method, the contribution margins with and without the. It can be removed, ceasing to conduct the specified commercial. Defining a cost as fixed or variable has no effect on whether. Avoidable Fixed Costs Quizlet.

From www.chegg.com

Solved A large enough avoidable fixed cost may lead to a Avoidable Fixed Costs Quizlet one approach is to compare contribution margins and fixed costs. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. We will cover the avoidable. It can be removed, ceasing to conduct the specified commercial. In this method, the contribution margins with and without the. an avoidable cost is. Avoidable Fixed Costs Quizlet.

From exonksnma.blob.core.windows.net

Total Fixed Cost Curve Example at Dean Treadway blog Avoidable Fixed Costs Quizlet In this method, the contribution margins with and without the. We will cover the avoidable. Avoidable costs refer primarily to variable costs that can be. an avoidable cost is an expense that will not be incurred if a particular activity is not performed. one approach is to compare contribution margins and fixed costs. Defining a cost as fixed. Avoidable Fixed Costs Quizlet.

From quizlet.com

Is it True or False? When fixed costs are positive, the ave Quizlet Avoidable Fixed Costs Quizlet It can be removed, ceasing to conduct the specified commercial. in a sell or process further decision, consider the following costs: In this method, the contribution margins with and without the. We will cover the avoidable. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. some typical classes. Avoidable Fixed Costs Quizlet.

From quizlet.com

For the coming year, Loudermilk Inc. anticipates fixed costs Quizlet Avoidable Fixed Costs Quizlet In this method, the contribution margins with and without the. avoidable cost is a business cost incurred by a firm that does not serve a purpose. this blog will delve into avoidable costs and discuss how companies can identify and reduce them to improve their bottom line. It can be removed, ceasing to conduct the specified commercial. . Avoidable Fixed Costs Quizlet.

From quizlet.com

In general, what is the difference between fixed costs and v Quizlet Avoidable Fixed Costs Quizlet avoidable cost is a business cost incurred by a firm that does not serve a purpose. one approach is to compare contribution margins and fixed costs. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. Avoidable costs refer primarily to variable costs that can be. in a. Avoidable Fixed Costs Quizlet.

From www.chegg.com

Solved Question 2 (1 point) Suppose that two firms firms Avoidable Fixed Costs Quizlet Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. avoidable cost is a business cost incurred by a firm that does not serve a purpose. an avoidable cost is an expense that will not be incurred if a particular activity is not performed. some typical classes of. Avoidable Fixed Costs Quizlet.

From www.chegg.com

Solved Exercise 63A (Algo) Distinction between avoidable Avoidable Fixed Costs Quizlet avoidable cost is a business cost incurred by a firm that does not serve a purpose. in a sell or process further decision, consider the following costs: one approach is to compare contribution margins and fixed costs. this blog will delve into avoidable costs and discuss how companies can identify and reduce them to improve their. Avoidable Fixed Costs Quizlet.

From quizlet.com

For the coming year, Loudermilk Inc. anticipates fixed costs Quizlet Avoidable Fixed Costs Quizlet In this method, the contribution margins with and without the. Avoidable costs refer primarily to variable costs that can be. some typical classes of avoidable costs include direct materials, direct labor, variable overheads, directly linked. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. in a sell or. Avoidable Fixed Costs Quizlet.

From study.com

Quiz & Worksheet Avoidable Costs Avoidable Fixed Costs Quizlet in a sell or process further decision, consider the following costs: an avoidable cost is an expense that will not be incurred if a particular activity is not performed. Defining a cost as fixed or variable has no effect on whether or not the cost is considered relevant. In this method, the contribution margins with and without the.. Avoidable Fixed Costs Quizlet.